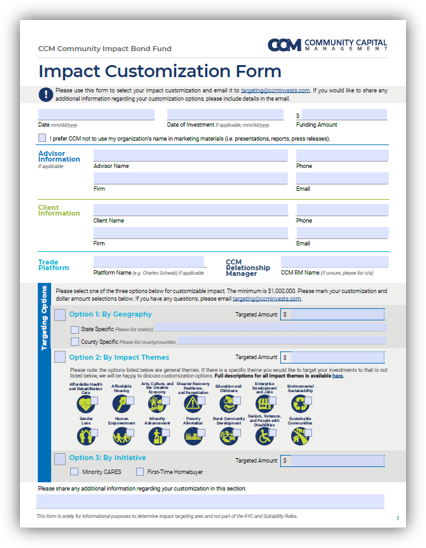

Impact By Theme

Investments customized to impact themes can target one or more of CCM’s impact themes. When a client selects customization by impact theme, the investments will support those specific impact themes nationwide. Click on an impact theme to read its full description. Click here for full descriptions of all impact themes including a glossary of terms.